Every e-commerce website needs to have some features that it absolutely must have to do business, and the most essential of them all is a payment system. Without a proper payment method, you simply won’t get paid and customers won’t have any way to purchase items. If you can’t take online payments the purpose of your business, which is to make money, would be impossible.

The online marketplace is ultra-competitive today and having more than one way to accept payments has become a necessity more than a requirement. It puts you at a distinctive advantage because you’re not going to be relying on one main payment source. Most e-commerce businesses have several online payment methods to choose from, with each one offering a secure and intuitive checkout experience.

To ensure that you’re offering the best payment methods to your visitors, and capturing as many sales as possible, we’re going to share the main information you must know about online payment methods and the best options available in the marketplace today.

Contents

1- What Are Online Payment Gateways?

Online payment gateways are services for e-commerce websites that process payment information for your website. These online payment gateways provide two main benefits to e-commerce businesses:

1.1- Making Checkout Easier and Faster

You must be familiar with the purchase process at most online stores and at some stores must have realized that the payment process took too long and required more work that you were willing to do. That’s a common compliant for most online shoppers, and that clearly shows with the average rate of shopping cart abandonment standing at 70%. These were people who displayed a clear intent to purchase and then didn’t buy anything.

If your checkout process creates barriers in the purchase process, you’re going to end up losing sales as people simply don’t have the time to fill out needless steps. A good online payment gateway makes the process intuitive and simple so that you end up gaining more sales instead of losing them.

1.2- Keep Customer’s Information Secure with Encryption

The threat of identity theft is very real and that means that every customer that makes an online transaction wants their information secure. That requires trust in the online payment system and as a business that responsibility lies solely on your shoulders. You have to ensure that the sensitive information provided by customers is protected from hackers around the web, who are looking to steal credit card information from vulnerable websites.

As online payment gateways specialize in processing financial information, they need to have the proper safety features and encryption to keep customer’s information safe.

2- Why Provide Multiple Online Payment Methods?

Even though it is possible to get by with only one safe and easy online payment method for an e-commerce store, most customers today have an expectation of using their preferred payment methods on websites all over the internet. So, if you don’t offer their preferred payment method they will take their business to a website that does provide them with that option.

The growing popularity of services such as Apple Pay, PayPal, and Square has meant that customers now have an increasingly long list of ways to checkout on websites without spending time adding all their payment and address information for every purchase. Instead, all they must do is log into their account that they use regularly, and in most cases they don’t need to do that as well since the device remembers their important information.

This ends up creating a convenient and seamless experience for them, especially when they’re shopping on mobile, where most online purchases take place today. More and more visitors are expecting this kind of convenience from e-commerce stores and they are less likely to shop at a place that makes them do extra work during the purchasing process.

3- Is It Worth the Time and Effort to Add New Payment Options?

In a survey, Bayard found that 19% of shoppers who abandoned their cart said that they didn’t trust the website with their credit card information. A further 8% directly said that there weren’t enough payment options offered by the website. For the average e-commerce store, 70 out of 100 shoppers who added an item to their cart are going to bail.

Around 20% of them will do that because they’re not satisfied with the current online payment options that you’re offering to them. When you add additional payment options, you can convert nearly 15 of those 70 shoppers (20%), and if you add the payment options that they prefer you can convert a further 10% of them to shop at your store.

Earning nearly 25 more conversions per 100 potential shoppers seems like more than a worthwhile investment by your website, and you can do that by simply adding more payment options.

4- How to Choose the Best Online Payment Methods?

First off, here are some of things you must consider to pick out the payment methods that best suits your business. Here are some of the things you must keep in mind when making your choice:

4.1- Recurring or Single Payments

If you’re thinking about setting up recurring payments, you must find a method that supports them. However, if you’re only taking single payments, you will have more flexibility when it comes to the payment methods you can use.

For instance, if you’re a B2B company, you’ll want your customers to have automated reorders, but most online payment methods don’t support them. You will also need to check the flexibility for scheduling and payment amounts.

4.2- Accepted Currencies

If you’re operating with a single currency, selecting a payment method is going to be easier for you. However, accepting currencies all over the world can make things more complex for you, which is what most businesses are doing. You wouldn’t want to count out potential businesses simply because those customers are based in another country.

However, you’ll need payment software that ends up calculating the exchange rate for you and offers prices in the currency that your customers are using. If they’re stuck calculating currency exchanges on their own, they will go somewhere else.

4.3- Company Location

The location of your business also affects the best payment methods that you can choose. For instance, there are going to be laws governing payment providers in a specific country. If you’re not in the same country, those laws can become a hindrance to your business operations. You must ensure that there aren’t any processing holdups during geographical, legal, and other differences between countries.

4.4- Service Reviews

You should also check out the reviews of a payment method’s service before you commit to it, and read up on what people who have used this method say about it. You should also consider factors like the industries of the companies that have used this method with success and whether they are in a similar industry as yours or do most of their customers come from different industries.

5- The Best Online Payment Methods You Should Consider

The online payment services currently on the market all aim to provide easy and secure ways to pay. Each one of them has different reasons to consider using them, and these options are as follows:

5.1- PayPal

PayPal is one of the most familiar and biggest online payment options out there today, with over 254 million users all over the world. That’s a significant amount of people who would find it easier to shop on your website if you offer them the option to checkout with PayPal. The service alone boasts that it is currently used by over 17 million businesses and that customers who check out with PayPal convert at 82% higher rates than with other payment options.

That’s a very compelling reason to use PayPal as a payment option on your website, and luckily adding a PayPal button to the checkout process is a simple task, and one that we can easily do at SEO Resellers Canada. As a business you will need to pay 30 cents plus 2.9% for every purchase that is processed through PayPal.

5.2- Amazon Pay

PayPal may be one of the most popular payment options out there but Amazon is undisputedly one of the most popular websites across the internet. It is one that almost all your customers will have accounts with already, and adding Amazon Pay to your e-commerce store will make it easier for Amazon customers to shop with you, without adding their payment data in your checkout.

You’ll be making it easier for hundreds of millions of customers by offering them with a payment option that Amazon promises has proven fraud protection. This payment method works well on mobile devices and provides a seamless experience where it matters most.

Setting up the Amazon Pay button on your website will only take a few minutes with their Express Integration option, and you can also use their API, which may take longer, but allows you to customize the experience to fit your website better. The cost of using Amazon Pay is the same as with PayPal.

5.3- Google Pay

Google is the only company that can compete with PayPal and Amazon for their market share. The company offers their own online payment method called Google Pay to compete with others in the payment method market. Google claims that hundreds of millions of its users have already saved their card information with Google accounts, and offering the Google Pay option only adds further convenience for payments to their customers.

They promise an intuitive payment process on mobile and desktop along with top-notch security through encryption. Google Pay also allows retailers to set up loyalty programs, deals for customers, and digital gift cards, so everyone can skip paper and plastic cards. Google Pay also works with Visa Checkout and PayPal for additional reach, and the best part is that they don’t charge you anything for using the service, as it is free for the business and its customers.

5.4- American Express

American Express may not offer the same level of market share as our first three online payment gateways manage to do, but it offers something else that is just as valuable, consumer trust. Even though American Express is not as popular as some of its other credit card competitors, it offers one of the highest satisfaction rates in the industry, and tends to target a higher-income consumer than other credit card companies manage.

So, people who find an America Express checkout option attractive are going to be the top visitors that you’re going to attract to your website. American Express offers 24/7 customer support, fraud protection, and the flexibility to work with several payment processors with different add-on features. They can accept over 120 currencies, so if you’re interested in attracting international clients, that’s going to be a big benefit for you.

The only catch with American Express is that this payment option is going to cost you more than your other choices. The prices for American Express’s gateway begin at $20 a month for 100 transactions, and will go up for additional transactions. They also have a setup fee on top of that, which starts at $99. If you think that you’re going to get a lot of high-value customers, then you’re going to benefit from an AmEx gateway, as that’s the only way the cost is going to be worth it.

5.5- Apple Pay

The current number of people who use Apple devices number in the millions, with more than 64% of people in the United States currently owning Apple products. Apple Pay, works as a mobile wallet for people when they’re out and about, and offers a one-click payment option on websites that accept this payment option. For mobile users it doesn’t get any easier than this option, as they can check out from any website through their touch identification.

Apple Pay uses tokenization to keep credit card information secure, which means that once a user shares their credit card information with the service, the device communicates with the bank and generates a random number (token) that represents that card. This hides the information from hackers, and keeps consumers’ financial data safe and working quickly.

You can easily set up your website to accept Apple Pay by using their API, if you’re already using one of their compatible platforms or payment providers. The best part is that just like Google, Apple’s payment gateway is completely free for both customers and merchants.

5.6- Stripe

Stripe also offers a feature-rich payment processing platform that makes it easier to accept payments from an extensive range of sources, i.e. digital wallets, credit cards, ACH transfers, and different currencies. They also offer an extensive range of options for the checkout process, and with the right coding skills, you can add their embedded checkout to your website with a simple line of JavaScript, or create a unique payment form with their custom UI toolkit.

Most of the payment options we have looked at so far are mainly useful as an add-on checkout option, but Stripe offers a basis for other payment options to be added onto. As with the other online payment options Stripe also costs 30 cents plus 2.9% for domestic credit card processing and .8% for ACH payments.

5.7- Square

Even though Square is mainly associated with in-person point-of-sale (POS) payment processing, the company also provides e-commerce payment options. They have an online payment API that accepts most of the payment methods we have discussed above, along with credit card payments.

Apart from payment processing, they provide an easy checkout solution that helps customers set up profiles at the same time that they offer their payment information. Like most of their options, Square charges around 2.9% plus $.30 per payment.

5.8- Visa Checkout

Similar to the payment gateway offered by American Express, Visa Checkout makes it easier for Visa cardholders to check out from any website without needing to fill in their payment information. There are over 2 million people enrolled in Visa Checkout so you would be making the checkout process easier for a large number of your audience.

That convenience will clearly make a difference, because Visa’s data shows that offering Visa Checkout increases conversions by 42%, and the payment option comes with easy setup options and advanced security features.

5.9- Masterpass

MasterCard’s Masterpass payment gateway is similar to the ones offered by American Express and Visa, as it makes it easier for MasterCard holders to quickly and easily checkout from any website. It offers the kind of advanced security in the payment process that you would expect from a credit card company, and includes tokenization, user verification, fraud monitoring, and issuer verification.

MasterCard also doesn’t charge any fees from the merchant or the customer, and the company has developers that will help you set up the payment gateway.

5.10- 2Checkout

2Checkout is a global payment processing solution that accepts payments from all over the world in various countries. They offer a customizable checkout that you can design and add to your website, with extensive fraud protection, along with a responsive design that ensures customers can easily check out through their devices.

They provide an API that makes adding the processing solution to any website fairly simple, and also offers the flexibility to customize when you need to. The company only charges 2.9% plus 30 cents per transaction, with additional fees for foreign customers.

6- Ways to Make the Payment Process Easier for Online Customers

If your goal is to increase conversions and sales, making the payment process easier for online customers is the best way to go about it. That’s the reason why your checkout page is crucial as it is the final stop for people who are shopping on your website. It’s the place where they will hand over their credit card information and part with their hard-earned cash.

It’s easy to slap PayPal on your website and call it a day, but if you’re really serious about making it easier for your customers to pay and increase sales for your business, you must have complete control over the checkout process. Here are some of the best tips that will help you do that:

6.1- Offer Several Payment Methods

This may sound obvious, but there are plenty of websites out there that only offer one payment method to customers. However, data gleaned from an infographic from Milo revealed that 56% of respondents expected a variety of payment options on the checkout page.

It may not be necessary or practical to provide every conceivable payment method out there, but you must look at your target audience and find out what payment options they use or prefer. That way you’ll manage to capture most of the people that are visiting your website.

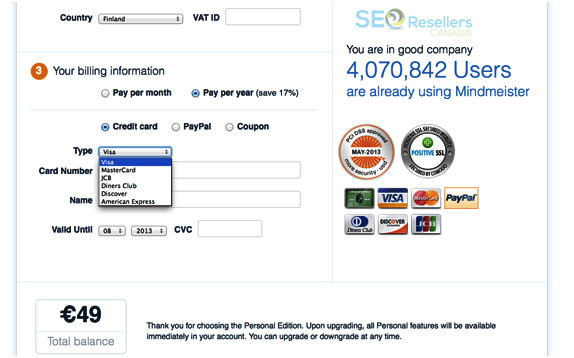

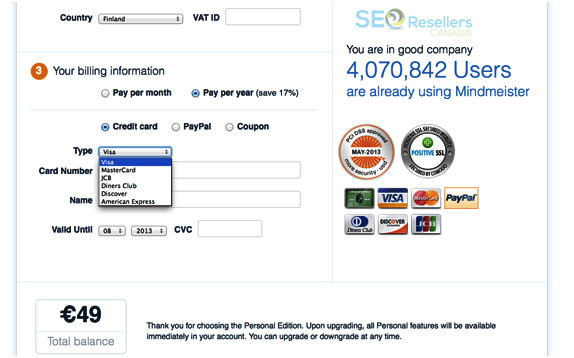

For example, a good combination would be to allow direct bank transfers and payments from all major credit cards, because at the end it all depends on who’re you catering to. The screenshot below shows that MindMeister allows users to pay with several credit cards, a coupon or with PayPal.

6.2- Allow Payments without an Account

Customers don’t want to remember another user name and password when it comes to shopping online and forcing people to sign up for another account is too intrusive for first-time customers. A study by Smashing Magazine found that the main reason users hate setting up accounts is because they expect to be flooded by promotional emails soon after.

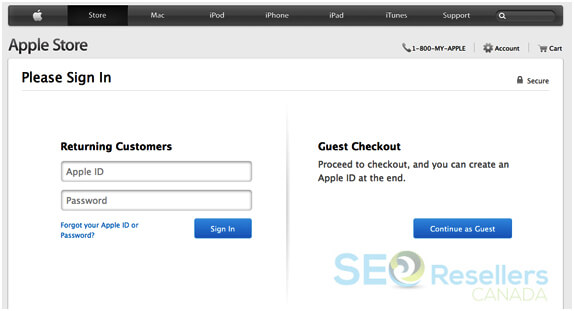

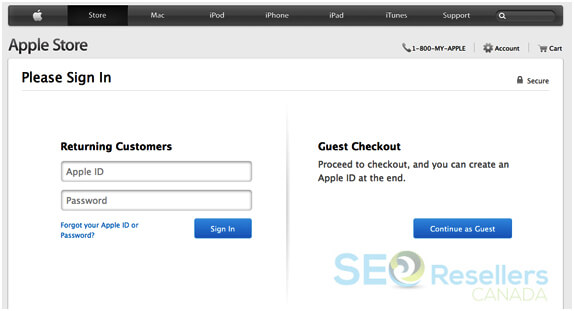

It also showed that most customers don’t understand why they need to sign up to buy a product when brick and mortar stores don’t require them to set up an account to buy stuff. Another disadvantage is that it adds more fields for people to fill out and prolongs the payment process. You can make things easier for potential customers and allow them to check out as a guest, similar to what Apple does:

The screenshot above shows that Apple gives customers the option to sign up at the end of the checkout process instead of forcing them to hand over their data at the start.

6.3- Deliver a Seamless Design

Solely from a branding perspective you want to keep everything as consistent as possible, which means using the same colors, fonts, and designs on your checkout page and the rest of your website. That will raise the brand recognition of your business, and some online payment providers deliver the front-end ready made for you, but you’ll give up the control over the look and feel of your checkout page.

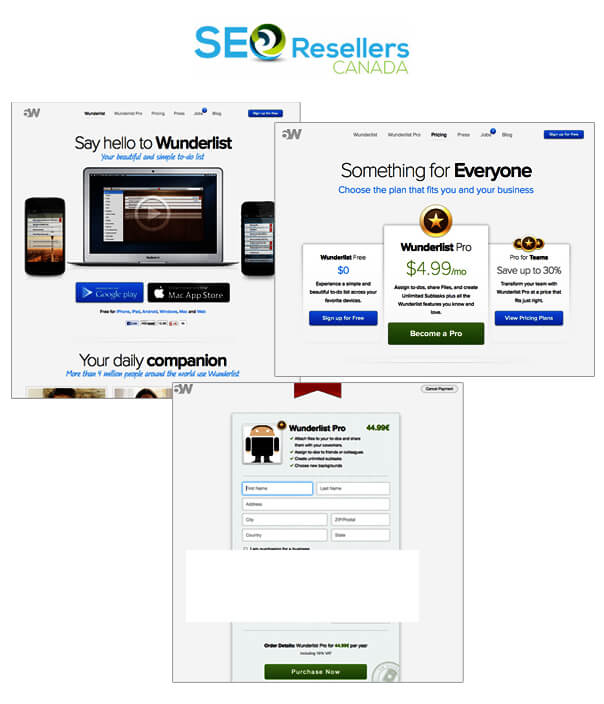

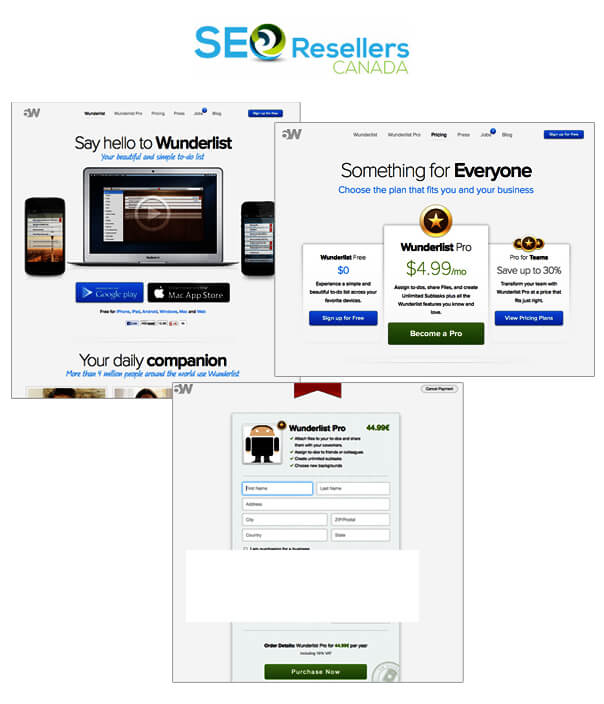

That makes people skeptical when they come across a checkout page that is different from the website that they were shopping from. Thanks to all the online scams and horror stories out there. To help raise brand awareness, you should keep your design consistent across all channels, especially the checkout page:

From the screenshots above, you can notice that 6Wunderkinder’s payment page matches the theme of their entire website.

6.4- Don’t Redirect People

You worked hard to get to your website, so why would you want to send them away to another website when it comes time to pay? That’s the main disadvantage of using a service such as PayPal, which redirects people away from your website to a checkout page. As you have no control over the design of the checkout page, your customers will end up feeling as if they are giving their money to a business that is different from the one they are buying from.

Checking out and paying will be the last thing that people do, which is why you want your business’s name to be the last thing on their minds.

6.5- Make Errors Easy to Fix

It’s a given that people are going to make mistakes during the payment process, and it may be as simple as overlooking the zip code or forgetting the ‘@’ in their email address. In such cases, you should make it easier for people to identify the error and correct the error on the same page. Some checkout pages will display the error message on top of their page, but most people don’t realize that they need to scroll up all the way to find out what went wrong.

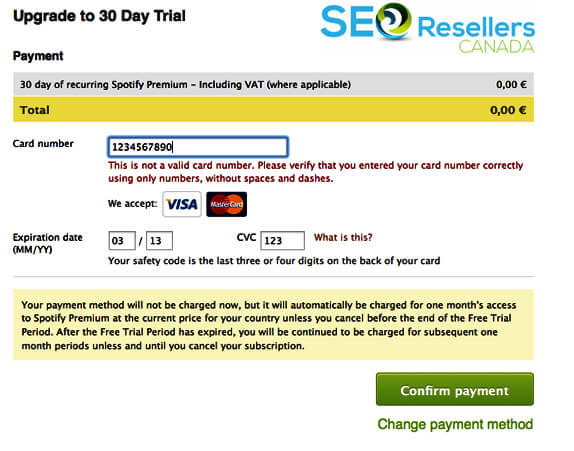

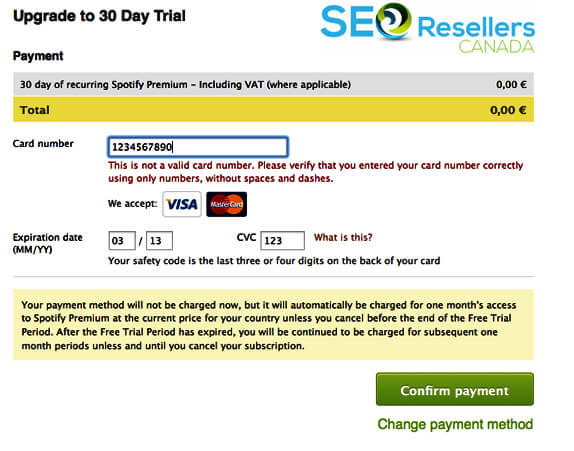

Ideally, you want the error message to appear on the field where the error was made. Another great tip for making it easier for people to pay is to allow them to save the information they submit. In the screenshot below, you will see how Spotify doesn’t clear the data that was already submitted and clearly displays the error message in red, which explains the reason for the error.

For longer forms, there is nothing more annoying than having to resubmit all your information again because of one mistake that you made. An infographic by Invesp, shows that losing customers due to submission errors was ranked in the top 10 of conversion problems during checkout.

6.6- Ask Only for Essential Information

Similar to when you’re building an email list, you should limit the amount of information that you requesting to only the essentials. Nothing will kill a conversation faster than having to fill out a form with information that’s not necessary for making a purchase. Adding a long list of fields to fill out will only add more hurdles for people to jump over to make you pay.

This isn’t some 400m hurdles, as it’s a sprint where you want people to run through the checkout quickly and as smoothly as possible. A report published by Forrester found that 11% of adults in the U.S. abandoned an online purchase because they didn’t want to register or the website was asking for too much information from them.

To ensure you don’t lose out on customers because you’re asking for too much information, you should follow the example of Buffer’s payment form, shown below:

If you feel as if you need to ask that extra information, like a phone number, just make sure that you give an explanation as to why that is required.

6.7- Give Reassurances on Privacy and Security

Whenever there is personal information involved, you should always go out of your way to showcase the security measures that you have in place for people. A survey by eConsultancy, found that 58% of correspondents dropped out of the checkout page because they had concerns about the payment security. We already pointed out the importance of delivering a consistent design and not redirecting people to a third party checkout page, as it doesn’t help in building trust with the customer.

You’ll also want to have a Secure Sockets Layer (SSL) certification for your website to provide a secure connection and encrypt any credit card information. You will also want to comply with the standards of the PCI Security Standards Council (PCI SSC). PCI compliance is enforced by credit card companies, and the council itself manages the security standards for anyone who stores, transmits, or processes data of cardholders.

You must display your security credentials with SSL and PCI badges, similar to how the website below has done to convince customers and maintain their trust:

As you can see, they have shown the number of users they have to reassure people that others are using their service safely as well.

7- Conclusion

There are several online payment systems out there that you can use to conduct e-commerce activities, but it’s important that you choose the right one, which is in line with your business objectives. If you work with a digital marketing agency like SEO Resellers Canada, ask your account manager what they suggest based on their experiences.

The list of online payment systems we shared isn’t exhaustive and if your favorite online payment system didn’t make our list, please share it with us in the comments and tell us why you chose it over other online payment systems.